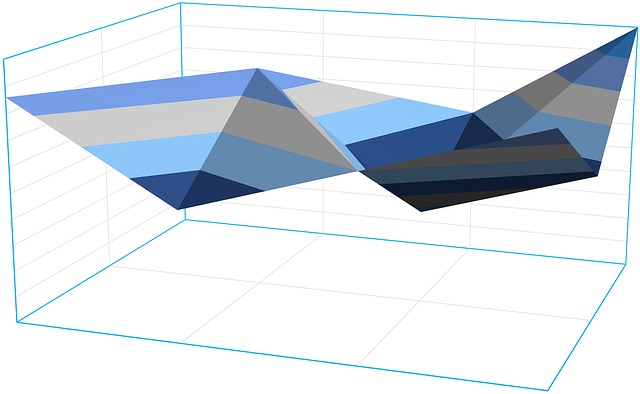

The year has not gotten off to a good start in the bond market world. In fact, it is the worst this market has been in decades.

According to the Bloomberg Aggregate Bond index, the bond market is down 6.66%. T.Rowe Price, a leading asset manager, reported the gravest bond market performance over a three-month period since 1980. The United States Treasury has not seen such low rates in a quarter since 1926 when data was initially collected.

And while it may not be easy to maintain bonds at this time, there are actually quite a few good reasons to hold on to them. Bonds are a safe bet; they can serve as a sort of insurance policy for the times when stocks and investments decline. Overall, bonds will always provide a return in an emergency. When everyone is looking to flee to stable economic waters, bonds are great assets to have. Specifically, Treasury Inflation-Protected Securities (TIPS) are doing exactly what they are meant to do: perform well during high inflation. Buying new bonds now will offer better interest rates in investment-grade corporate bonds now. These bonds are not as stable or safe as those from the Treasury, but they should be steady enough to provide a return when maintained through maturity.

Sorry, comments are closed for this post.